The IRS may correct math or clerical errors on a return and may accept returns without certain required forms or schedules.

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox.ĬHECK OUT: Single mom earns $10,000/month on Outschool: 'I would have never been able to make as much money as a regular teacher' via Grow with Acorns+CNBC.ĭisclosure: NBCUniversal and Comcast Ventures are investors in Acorns. "It's far more important to get this done right than get this done fast," he said. That means people should take their time getting an amended return together, said Markowitz.

#Amending turbotax return how to

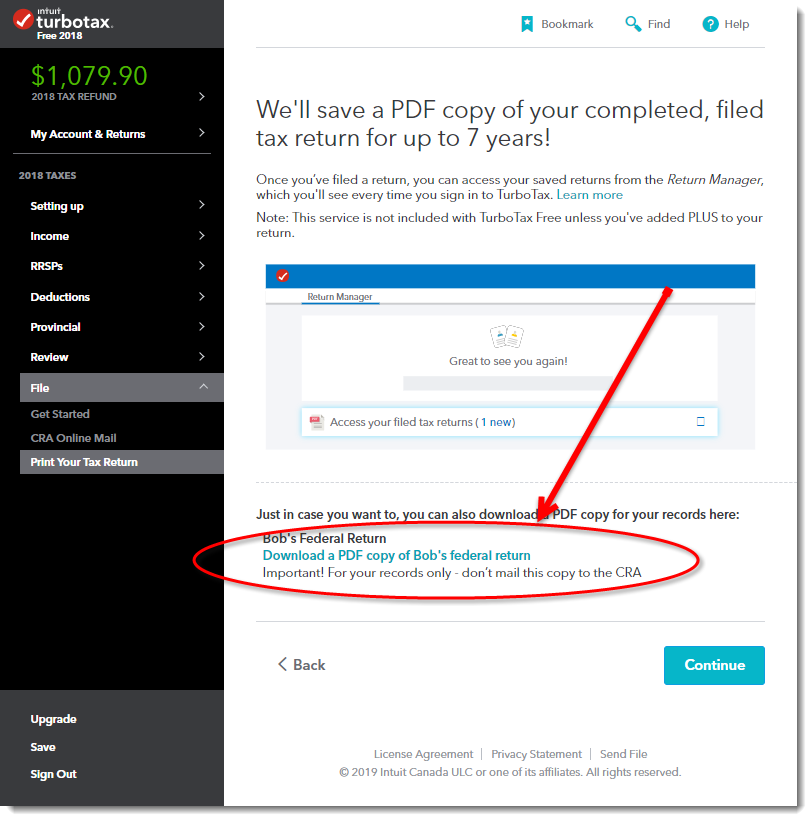

"There is going to be an unnecessary cost to the taxpayers here if they can't figure out how to do it on their own," said Adam Markowitz, enrolled agent with Howard L Markowitz PA CPA in Leesburg, Florida.Īnd, while some people may be eager to get back extra money they are owed, there isn't a tight deadline for filing an amended return - generally, you have up to three years from the date you filed your original return to send in your amended one and claim a refund. And, if the taxpayer can't figure out how to accurately file the amended return on their own, it could become a costly process. There isn't technically a limit to how many amended returns you can file, although doing more than one could get complicated. "The bottom of the first page of Form 1040-X then calculates how much you now owe or how much the IRS now owes you." "The crux of the form shows three columns: original amount, net change and corrected amount," said Susan Allen, CPA, senior manager for tax practice & ethics with the American Institute of CPAs. To fill out the form, you need the return you previously filed and know what information needs to be updated. Those who filed through other online tax preparation platforms should check with the provider to see if they offer amended e-filing and have the up-to-date form. An electronic Form 1040-X for 2020 is already available online from the IRS.

In 2020, the IRS made the Form 1040-X for amending returns electronic. If you do need to file an amended return, the good news is that you can now do it online instead of needing to mail in a paper form. "I don't know that they can fix the problem without the taxpayer getting involved."Įither way, it's best for taxpayers to wait at least a few weeks for more information before filing or trying to revise information they've already submitted to the IRS, said Renn. "I seriously doubt they have any ability to track who reported unemployment and paid tax on it and who didn't," said Edward Renn, a partner at Withers law firm. What to know before applyingīut it's just as likely that the IRS won't be able to do that, meaning that taxpayers will have to either file a another return to correct the information before April 15 - the current end of the tax season for individuals - or file an amended return after the deadline. More from Invest in You: Lost jobs, no child care: A year into the pandemic, women are not OK The IRS got 35 million tax returns in one week as Americans race to file Smallest businesses getting extra PPP help.

#Amending turbotax return update

If that happens, it would mean those people do not have to take any action to update their tax returns. If you already filed your 2020 return but had unemployment income and would have benefitted from the new Covid bill, there's a chance the IRS will take care of updating your information and sending you any money owed. Department of the Treasury and the IRS will be tasked with issuing guidance to taxpayers on what to do depending on their situation, something that could take weeks. "If you haven't filed a return for 2020 yet, you may just want to wait for this law to pass," said Eric Bronnenkant, a certified public accountant, certified financial planner and head of tax at Betterment. The House passed the updated version of the bill Wednesday but still needs to be signed into law by Biden, which he's expected to do Friday. A waiting gameįor now, experts say that no one should take any immediate action. Some taxpayers may now be stuck between filing their returns early to get a refund or waiting to make sure they get the benefits from the next Covid bill and possibly stimulus money they need. In addition, the timing of the bill puts other taxpayers with unemployment income in a difficult situation.

0 kommentar(er)

0 kommentar(er)